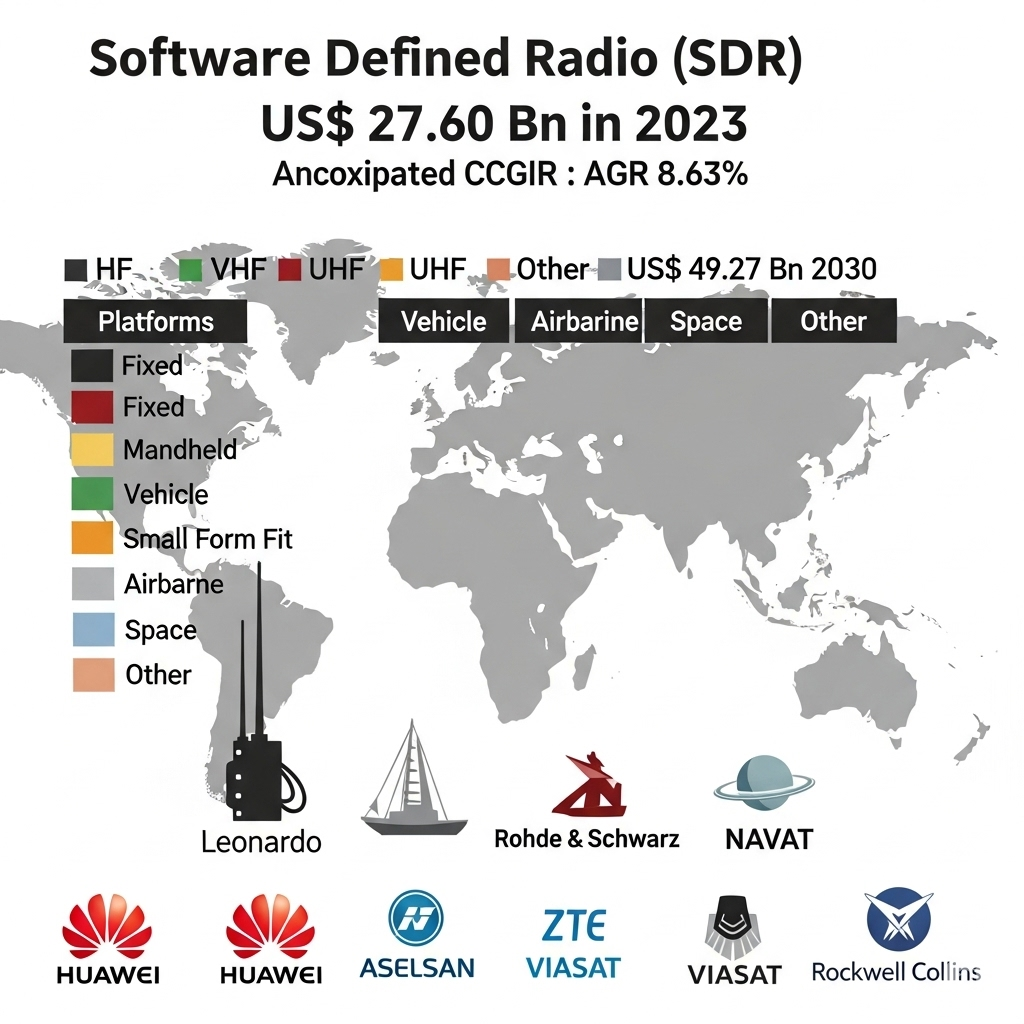

The global Software Defined Radio (SDR) Market was valued at approximately USD 27.60 billion in 2023 and is forecast to grow to USD 49.27 billion by 2030, at a CAGR of 8.63 % between 2024 and 2030, driven by the need for flexible, multi-frequency interoperable solutions in defense, telecom, and public safety.

United States – Growth & Consolidation

-

Growth: Dominating North America, the U.S. leads adoption, spurred by military, public safety, and 5G infrastructure needs .

-

Consolidation: Major industry players—L3Harris Technologies, General Dynamics, Northrop Grumman, Raytheon Technologies—are engaging in strategic M&A and partnerships to enhance agile communication solutions.

Asia Pacific – Opportunity & Trends

-

Opportunity: APAC is fastest-growing with a projected 9.7 % CAGR from 2025 to 2030, pushed by 5G buildouts and rising defense investment in China, India, Japan, South Korea .

-

Trends: Large-scale projects—like the Feb 2024 Bharat Electronics–Indian MoD USD 10 billion contract for SDR-Tac systems—highlight adoption in public safety and military spheres.

Europe – Trends & Updation

-

Trends: Europe sees strong SDR use in telecom, defense, and spectrum management; the region is expected to grow at ~8.2 % CAGR.

-

Updation: Governments and NATO-aligned entities adopt SDR systems for secure, interoperable communications; companies like BAE Systems, Thales Group, and Leonardo are actively innovating.

Middle East & Africa – Opportunity & Updation

-

Opportunity: Expanding defense infrastructure and 5G rollout e.g., in GCC countries, public safety require versatile communication platforms.

-

Updation: SDRs are being integrated into regional military modernization, emergency response, and telecom networks, supported by government RFPs and pilot programs.

To learn more about the insights of this research, click here

Competitive Landscape & Higher Demand

Major players like L3Harris Technologies, Thales Group, Northrop Grumman, General Dynamics, BAE Systems, Elbit Systems, and Rohde & Schwarz are at the forefront.

Higher Demand stems from the need for flexible, multi-band, software-configurable radios in defense modernization, zoonotic telecom environments, IoT, satellite comms, and public safety .

Key Recent Developments & M&A

-

Elta Systems (subsidiary of IAI) launched a high‑speed multi‑band SDR in March 2024 for HF/VHF/UHF/L‑band.

-

Savronik (Turkey) released advanced high-rate SDRs in March 2024, doubling throughput and encryption capabilities.

-

Viasat Inc. introduced the “Black ICE” SDR platform in Aug 2023, optimized for secure mission-critical communications.

-

Rohde & Schwarz acquired SSE in May 2022 to boost analytics and KI tools for Bundeswehr digital radio systems.

Regional Headline Summaries

-

“SDR growth in United States”: Budget boosts from defense and 5G rollouts raise adoption.

-

“SDR opportunities in Asia Pacific”: APAC surges with 9.7 % CAGR and mega-contracts like India’s SDR‑Tac.

-

“SDR trends in Europe”: Interoperable, spectrum-efficient systems embraced by defense and telecom.

-

“SDR consolidation in Middle East & Africa”: Strategic upgrades in regional military and emergency networks.

Related Reports: