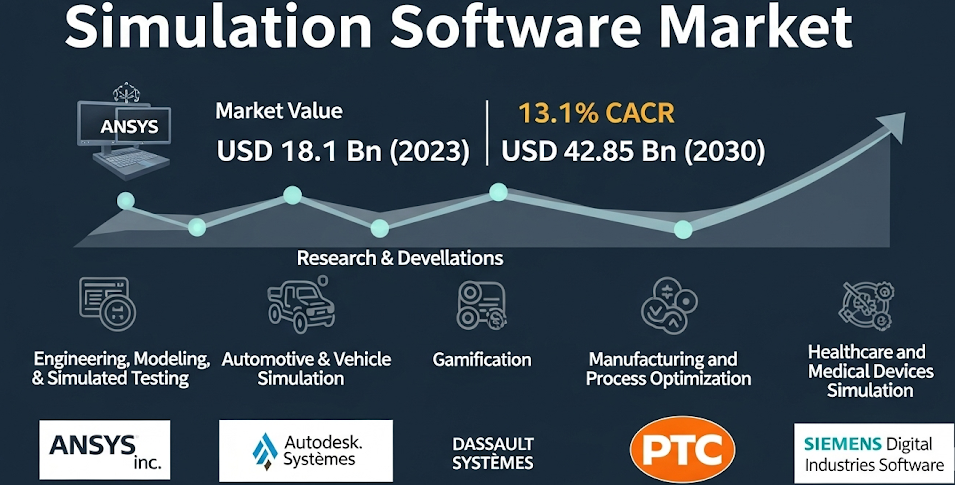

The worldwide Simulation Software Market is entering a pivotal phase of expansion, scaling from US $18.1 billion in 2023 to US $42.85 billion by 2030, a compound annual growth rate (CAGR) of 13.1 percent. As manufacturers, healthcare providers, energy majors, and mobility innovators race to compress design cycles and tame rising R&D costs, advanced modeling and virtual‑prototyping tools have become an indispensable part of the modern engineering stack.

Market Estimation & Definition

Simulation software comprises digital environments that replicate the behavior of physical objects, complex systems, or processes over time. By replacing costly physical prototypes with accurate computational models—ranging from finite‑element analysis (FEA) and computational‑fluid‑dynamics (CFD) solvers to agent‑based logistics simulations—organizations gain data‑driven insights into performance, safety, and efficiency long before the first hardware is machined or the first line of code is frozen.

-

2023 baseline: US $18.1 billion revenue

-

2030 forecast: US $42.85 billion revenue

-

Seven‑year incremental value: US $24.75 billion

-

Headline CAGR (2024‑2030): 13.1 percent

These figures reflect both on‑premise licenses and cloud‑delivered subscriptions, as well as associated professional services such as consulting, model validation, and training.

Growth Drivers & Emerging Opportunities

-

Product‑complexity explosion — Electrification, autonomy, and connectivity push design envelopes beyond what traditional test rigs can handle. High‑fidelity digital twins allow engineers to iterate thousands of “what‑if” scenarios overnight, radically shrinking time‑to‑market.

-

Industry 4.0 and smart‑factory initiatives — Manufacturing executives view end‑to‑end simulation as the “central nervous system” of the connected factory, from robotic path‑planning to predictive maintenance. According to Precedence Research, North America’s adoption curve alone is tracking at a phenomenal 30.95 percent CAGR through 2034.

-

Rise of cloud‑native platforms — Pay‑as‑you‑go high‑performance computing (HPC) capacity democratizes simulation for small and mid‑sized firms. ResearchAndMarkets notes that cloud‑based simulation applications will top US $12.3 billion by 2030, with automotive, aerospace, and healthcare as the fastest adopters.

-

AI/ML acceleration — Surrogate modeling, reinforcement learning, and automated meshing reduce run‑times and streamline model setup, while real‑time analytics feed continuous‑improvement loops on the shop floor.

-

Sustainability mandates — Digital twins help optimize material usage, energy consumption, and lifecycle emissions, supporting global ESG reporting frameworks.

Segmentation Analysis

Software Type

-

Electronic Simulation Solutions hold pole position, driven by soaring semiconductor complexity. From transistor‑level SPICE solvers to full‑package electromagnetic analysis, these tools ensure signal integrity and thermal reliability in next‑generation chips and power‑electronics assemblies.

-

Process & Multiphysics Suites weave together structural, fluid, thermal, and chemical domains, enabling holistic system validation—for instance, crashworthiness studies that concurrently model air‑bag deployment, occupant biomechanics, and battery‑pack fire propagation.

-

CAD‑Embedded Simulators are gaining traction among design engineers who prefer “analysis‑in‑context,” eliminating file conversions and version‑control headaches.

Deployment Mode

-

Cloud subscriptions are the growth engine, valued for elastic GPU/CPU pools and seamless collaboration across globally dispersed teams. Built‑in DevSecOps pipelines simplify updates and security patches, relieving IT bottlenecks.

-

On‑premise deployments remain essential in defense, nuclear, and pharmaceutical environments where data‑sovereignty and deterministic run‑times are non‑negotiable. Hybrid architectures that burst heavy jobs to the cloud bridge the two worlds.

Application Lens

-

Manufacturing & Process Optimization commands the largest share. Digital production lines simulate material flows, robotic kinematics, and workforce ergonomics to uncover bottlenecks long before capital equipment is ordered.

-

Engineering, Modeling & Simulated Testing addresses early‑stage concept validation, from wind‑tunnel CFD of ultra‑light aircraft to stress‑strain analysis of biomedical implants.

-

Gamification & VR/AR Training turn physics‑accurate models into immersive learning modules, reducing operator errors in high‑risk sectors such as oil & gas and emergency response.

End‑Use Verticals

Automotive leads in dollar terms, spurred by the electrification wave and stringent safety norms; aerospace & defense follow closely, relying on mission‑critical simulation for avionics, propulsion, and battlefield logistics. Meanwhile, pharmaceuticals are leveraging population‑scale epidemiological models to anticipate therapy outcomes and clinical‑trial site selection.

Discover the latest trends and analysis—click here for more details

Country‑Level Spotlight

United States

The U.S. remains the bellwether, underpinned by deep R&D budgets, a vibrant start‑up ecosystem, and defense modernization programs. Grand View Research confirms that the U.S. held the dominant national share in 2024, buoyed by heavy software spending in aerospace, semiconductors, and digital health. Expectations point toward US $12.5 billion by 2035, fueled by government tax incentives for tech‑driven manufacturing and the CHIPS Act injecting capital into fab expansions.

Germany

Europe’s manufacturing powerhouse continues to set the benchmark for industrial simulation. German automakers employ extensive digital‑twin environments to optimize EV drivetrains, adaptive chassis systems, and over‑the‑air software updates. According to Grand View Research, Germany recorded “a substantial market share” in 2024, propelled by its world‑class machinery and robotics clusters. Federal programs such as “Industrie 4.0” and generous R&D tax credits further accelerate adoption across Mittelstand suppliers.

Commutator Analysis — Mapping the Interplay of Market Forces

A “commutator” in electronics continuously reverses current direction; likewise, the simulation software ecosystem thrives on the dynamic interchange between five currents:

-

Technology Vendors ↔ OEMs — Giants such as ANSYS, Siemens Digital Industries, Dassault Systèmes, Altair, and Autodesk iterate toolchains in lockstep with OEM pain‑points. Siemens’ recent US $10 billion bid for Altair underscores the scramble to consolidate multiphysics and data‑analytics capabilities under one roof.

-

Cloud‑Service Providers ↔ Independent Software Vendors (ISVs) — AWS, Microsoft Azure, and Google Cloud furnish elastic HPC grids; ISVs reciprocate by containerizing solvers and offering usage‑based licensing, unlocking new SMB segments.

-

AI Start‑ups ↔ Legacy Toolchains — Emerging players deliver physics‑informed neural networks and generative meshing, augmenting—rather than replacing—established finite‑element kernels. The resulting hybrid workflows slash compute times while preserving solver fidelity.

-

Regulators ↔ Industry Consortia — Aviation authorities mandate virtual certification of flight‑control software; automotive safety bodies endorse virtual NCAP crash testing. Standards groups labor to harmonize data schemas, ensuring simulation results remain legally defensible.

-

Academia ↔ Workforce Skilling — Universities integrate hands‑on digital‑twin curricula, feeding a talent pipeline adept at both domain physics and Python scripting. Vendors reciprocate with campus licenses and hackathons, cultivating brand loyalty.

Conclusion

The global simulation software arena stands at an inflection point. Rising product complexity, relentless time‑to‑market pressures, and the imperative for sustainability are converging to make virtual prototyping the default engineering paradigm. With revenue on track to soar past US $42 billion by 2030 and double‑digit growth visible across every major region, the sector is poised for a decade of sustained momentum.

For enterprises, the message is clear: embedding simulation and digital‑twin thinking across the product lifecycle is no longer a specialist luxury—it is a competitive necessity. Those that harness the power of physics‑accurate models, cloud‑scale compute, and AI‑driven optimization will out‑innovate, out‑manufacture, and out‑perform peers still tethered to trial‑and‑error.

Related Report: