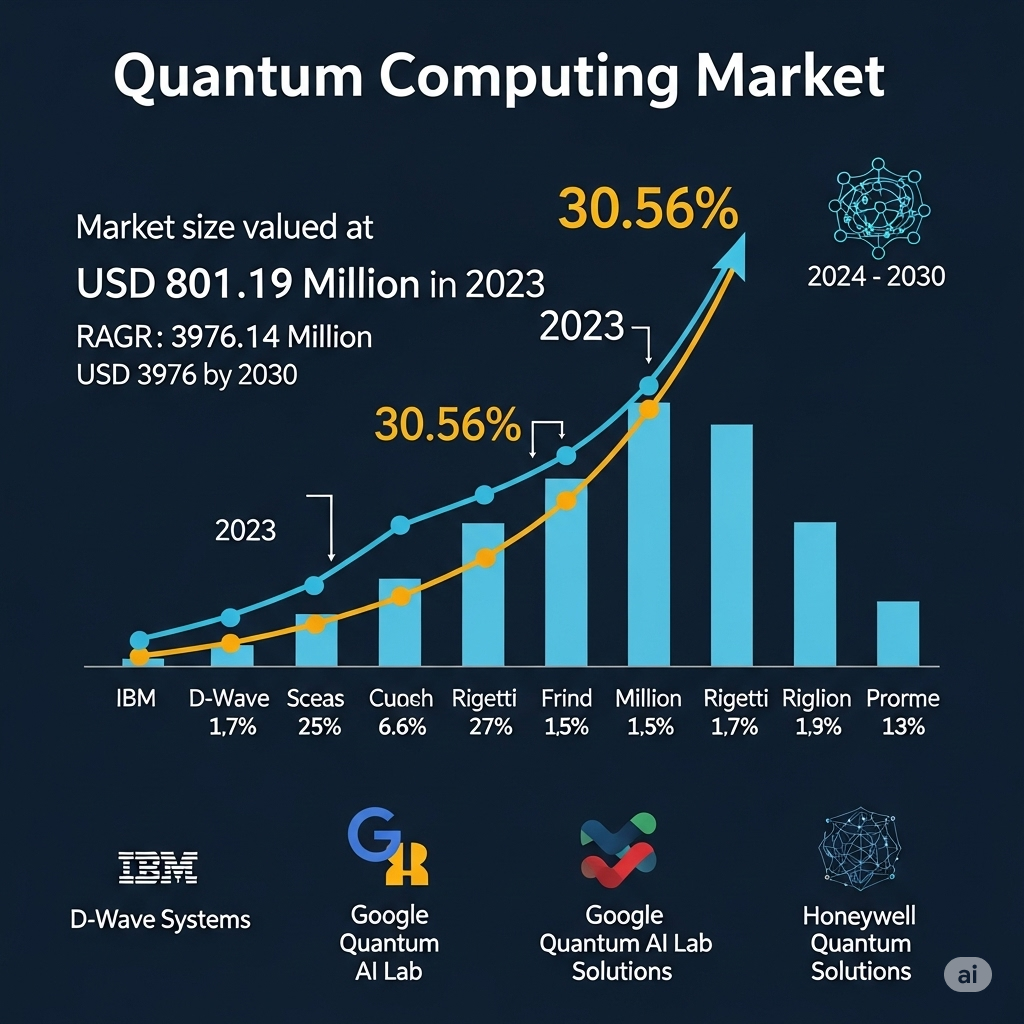

The global Quantum Computing Market, valued at USD 801.2 million in 2023, is projected to surge to USD 3.976 billion by 2030, growing at a 30.56 % CAGR between 2024 and 2030. This surge is driven by expanding applications in finance, healthcare, defense, and logistics, alongside sizable investments in research and cloud-based quantum services.

United States – Growth & Consolidation

The U.S. leads North America and stands at the forefront of quantum innovation.

-

Growth: Government funding and enterprise interest fuel rapid expansion.

-

Consolidation: IonQ is acquiring UK’s Oxford Ionics for ~US $1.08 billion, consolidating trapped-ion tech leadership.

Asia Pacific – Opportunity & Updation

The APAC region is rising fast thanks to strategic investments in quantum infrastructure.

-

Opportunity: Countries like China, Japan, Australia, and South Korea are scaling quantum-as-a-service and hardware deployment .

-

Updation: Australia’s Silicon Quantum Computing, backed by government grants, is pioneering silicon-based qubits.

Europe – Trends & Consolidation

Europe is carving its niche in trapped-ion and secure quantum systems.

-

Trends: Quantinuum (Honeywell + Cambridge Quantum) delivers record-setting quantum volumes, advancing quantum AI & cryptography.

-

Consolidation: IonQ’s takeover of Oxford Ionics underscores the U.S.–UK quantum strategy.

Middle East & Africa – Opportunity & Updation

MEA is positioning itself with robust infrastructure and tech adoption.

-

Opportunity: Expansion in finance, energy, and nuclear sectors is opening fresh use cases.

-

Updation: Regional governments are announcing pilot initiatives and academic partnerships to modernize quantum research capabilities.

For a complete look at the findings, visit the link

Competitive Landscape & Higher Demand

Leading players—IonQ, D‑Wave, IBM, Google, Quantinuum, PsiQuantum—compete fiercely in both hardware and cloud domains.

-

D‑Wave, with its Advantage2 annealer (~4,400 qubits), is achieving strong Q1 2025 results.

-

IonQ raised US $372 million via equity offering in Q1 2025 to fund growth.

Key Recent Developments

-

IonQ–Oxford Ionics merger (~US $1.08 b)—a major step in fault-tolerant computing with trapped-ion tech.

-

McKinsey predicts quantum (including sensing/comm) could reach US $97 b by 2035, and US $198 b by 2040.

-

D‑Wave continues strong performance, stock up ~90 % YTD, commercializing quantum annealing.

Regional Headlines

-

“Quantum computing growth in United States”: IonQ acquisition expands U.S. leadership.

-

“Quantum computing opportunities in Asia Pacific”: Government-backed R&D and QCaaS adoption soar.

-

“Quantum computing trends in Europe”: Trapped-ion volume breakthroughs and secure cryptography rise.

-

“Quantum computing consolidation in Middle East & Africa”: Infrastructure renewal ushers innovation.

Related Report: