Omnichannel Retail Commerce Market – Engaging and Insightful

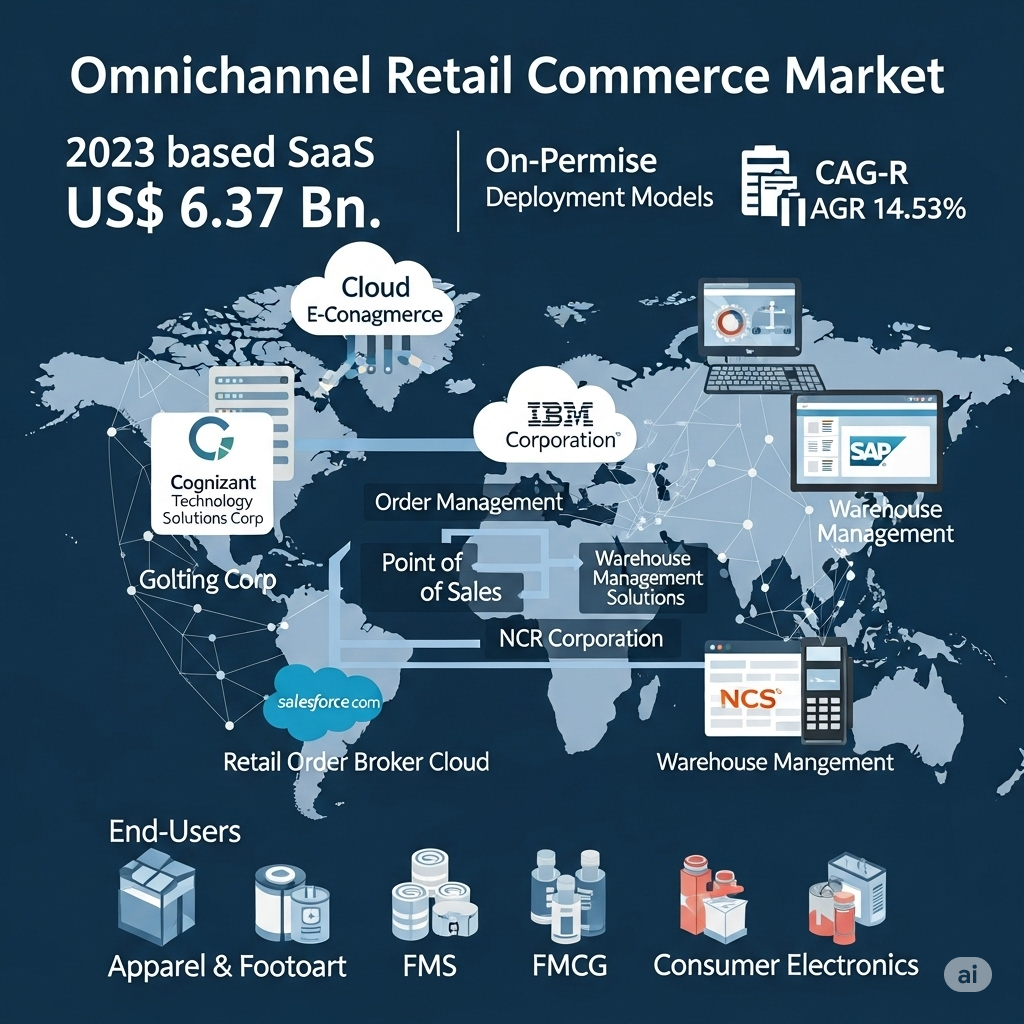

The Omnichannel Retail Commerce Market was valued at US $6.37 billion in 2023 and is projected to reach US $16.48 billion by 2030, growing at a strong CAGR of 14.53 % from 2024 to 2030.

Competitive landscape:

Major players such as Cognizant Technology Solutions, IBM, Salesforce, Oracle, SAP, Microsoft, Infosys, and NCR are investing heavily in cloud‑based SaaS and AI‑driven order‑management platforms.

Higher demand:

North America leads in adoption (34.2 % share in 2023), while Asia‑Pacific is the fastest growing region at an estimated CAGR of 18.3 % over the forecast period.

United States – Growth & Opportunity

The US market—accounting for the lion’s share of North America—is experiencing robust growth thanks to widespread E‑commerce integration, real‑time inventory visibility, and click‑and‑collect implementation .

Growth: Domestic SaaS deployments and POS integrations are surging.

Opportunity: Brick‑and‑mortar retailers are upgrading to hybrid models to boost customer loyalty and revenue streams.

Asia Pacific – Expansion Trends

Asia Pacific is witnessing explosive growth, growing at 18.3 % CAGR and driven by digital acceleration in China, India, Japan, and Southeast Asia.

Trends: Rising internet/mobile penetration and social‑commerce platforms are creating end‑to‑end omnichannel ecosystems.

Opportunity: Personalized, AI‑powered cross‑channel experiences are in high demand among tech‑savvy consumers.

Europe – Consolidation & Trends

Europe holds the second‑largest regional share after North America.

Consolidation: Prominent companies like SAP, Oracle, and Microsoft are acquiring retail tech startups across the UK, Germany, and France to boost unified commerce offerings.

Trends: Luxury and FMCG retail sectors lead in adopting omnichannel solutions, often integrating loyalty apps and analytics.

Middle East & Africa – Updation & Opportunity

Although smaller in market share (~6 %), the MEA region is displaying rapid modernization.

Opportunity: Retailers in the GCC and South Africa are investing in unified commerce systems—encompassing mobile‑POS, click‑&‑collect, and delivery‑management—to serve affluent and digitally‑engaged consumers.

Trends: International chains entering GCC markets (e.g., luxury brands) are launching omnichannel stores with enhanced loyalty features.

Interested to take a sneak peek? Request a sample copy of the report to see what’s inside

Region‑Specific Mergers & Acquisitions

-

United States: Tech giants (Salesforce, Oracle, SAP, IBM) are acquiring retail logistics and CRM startups to expand omnichannel portfolios.

-

Asia Pacific: JD.com is ramping up investments in China’s omnichannel supermarkets (7Fresh) and its European pick‑up points (Ochama expansion).

-

Europe: SAP and Oracle have acquired several local SaaS and AI order‑management providers to maintain competitive edge.

-

Middle East & Africa: Retail chains are partnering with global platform providers to integrate omnichannel systems—but no major M&A announced yet.

Key Recent Developments

-

The market for omnichannel platforms is projected to reach USD 12.88 billion by 2029, with a 14.4 % CAGR (2024–2029).

-

Research and Markets reports the global omnichannel commerce platform market at USD 9.4 billion in 2023, expected to hit USD 27.7 billion by 2030 (CAGR 16.6 %).

-

A recent industry study highlights that 73 % of consumers use multiple channels during shopping—the driver behind omnichannel investment.

Related Report: