Hybrid Cloud Market Overview & Definition

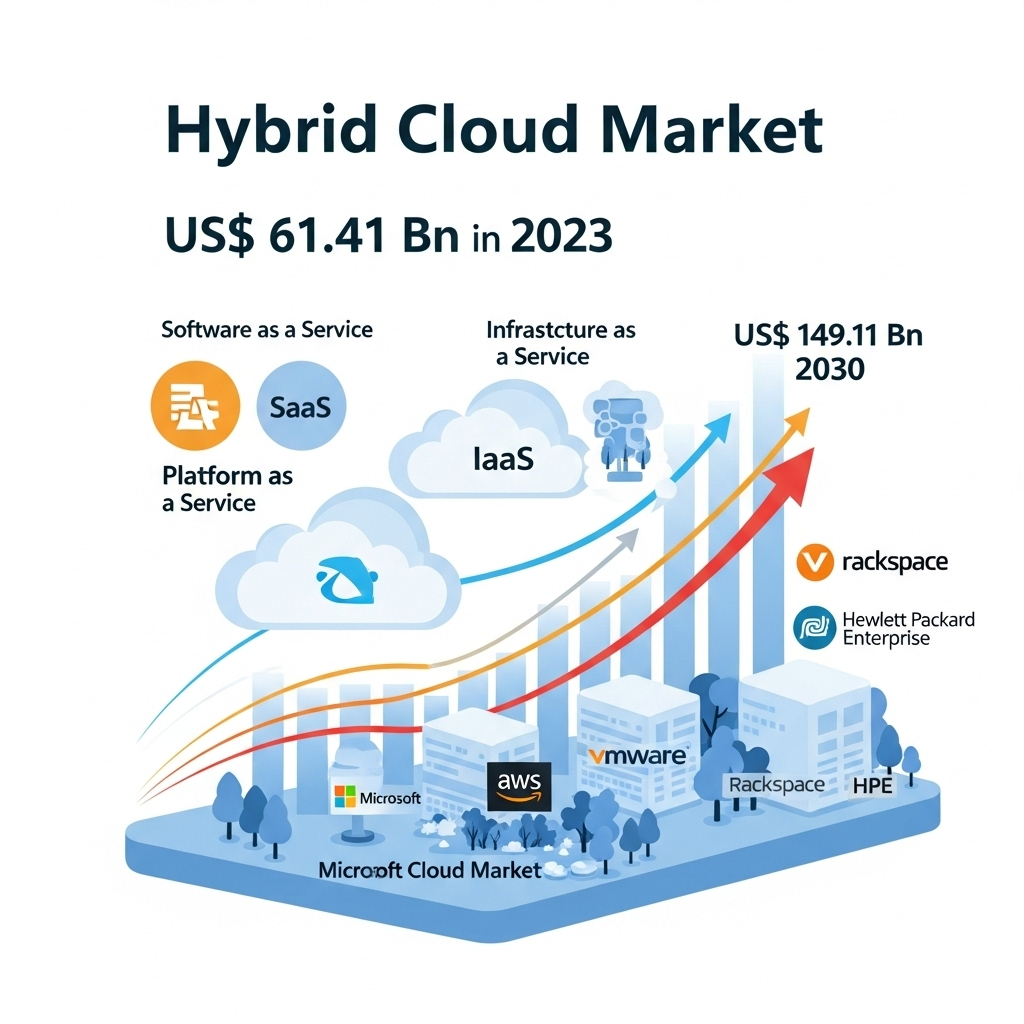

The Hybrid Cloud Market is rapidly transforming, with the 2025 valuation estimated between USD 61.41 billion and USD 149.11 billion, projecting a robust compound annual growth rate (CAGR) ranging 13.51% through 2024–2030 . This market trajectory reflects diverse insights:

Hybrid cloud is defined as an integrated IT architecture that combines on-premises infrastructure with private and public cloud services, enabling seamless workload mobility, tailored resource allocation, and unified management while preserving data control in secure environments .

Market Drivers & Opportunities

1. Digital Transformation & Business Agility

Organizations are shifting away from traditional IT setups toward hybrid environments to gain flexibility, scale, and responsive infrastructure amid competitive and regulatory pressures. The acceleration of cloud migrations due to the pandemic has cemented hybrid cloud as a cornerstone of modern IT strategy.

2. Security, Compliance & Data Sovereignty

Hybrid models enable enterprises to isolate sensitive workloads on-premises while tapping into public clouds for bulk processing and analytics. This duality satisfies strict data privacy and governance mandates imposed by regulations like GDPR and HIPAA . An academic study from May 2025 outlines frameworks for balancing performance, cost, and zero‐trust security across AWS and Azure deployments.

3. Scalability & Cost Optimization

Hybrid clouds blend elasticity with cost control, enabling businesses to scale on-demand without heavy capital expense. This appeals particularly to SMEs unlocking enterprise-grade infrastructure .

4. AI, Edge & IoT Enablement

Integration with AI, IoT, and edge computing is a major growth vector. Organizations seek hybrid architectures that process real-time data at the edge while aggregating intelligence in the cloud. Experts report that the amalgamation of cloud and edge could reach USD 2.39 trillion by 2030 .

5. Post-COVID Digital Continuity

The pandemic dramatically increased hybrid cloud adoption to ensure business continuity, remote operations, and resilient data systems.

Market Segmentation Analysis

1. By Component

-

Solutions: These include cloud management platforms, integration tools, security and backup systems. In 2024, solutions held the lion’s share—over 60–65% of the market. Their importance continues to grow as enterprises prioritize governance, compliance, and orchestration .

-

Services: Delivery of consulting, migration, managed services, and training. Services are expanding at CAGRs between 15% and 20% as companies seek specialist support for deployment and management.

2. By Service Model

-

SaaS: Dominated around 54–55% of the market in 2024, fueled by demand for CRM, ERP, and collaboration platforms.

-

IaaS: Rising at 14–17% CAGR as enterprises require scalable computing power .

-

PaaS: Fast-growing segment enabling developers to build and deploy apps more efficiently .

3. By Organization Size

-

Large Enterprises: Held over 60% market share, thanks to complex IT infrastructures and deep pockets .

-

SMEs: Exhibiting highest CAGR, estimated at 14–15%, as they adopt hybrid models for modernization and competitive differentiation .

4. By Industry Vertical

-

BFSI (Banking, Financial Services & Insurance)—largest vertical, holding ~23% in 2024, driven by data sensitivity and regulatory demands.

-

Healthcare & Life Sciences—growing at ~14% CAGR amid intelligence and compliance requirements .

-

Others: Public sector, IT/telecom, retail, manufacturing, and media—all investing in tailored solutions.

5. By Workload (per The Business Research Co.)

-

Storage, Backup & Disaster Recovery

-

Application Dev & Testing

-

Database Management

-

Business Analytics & CRM/ERP

-

Integration & Orchestration, Collaboration & Content Management.

Want to stay ahead with the latest data? Download your report sample: https://www.maximizemarketresearch.com/request-sample/24915/

Country-Level Analysis

United States

-

Market size stood at USD 41.08 billion in 2024, projected to reach USD 212.12 billion by 2034 (CAGR ~17.8%).

-

Leading hyperscaler AWS holds ~31% market share in cloud infra across NA.

-

Google Cloud and Microsoft Azure are aggressively expanding regionally and integrating AI and hybrid services via platforms like Anthos and Azure Arc.

Germany

-

As a major European hub, Germany is among the top EU adopters, with strong uptake in the public sector, automotive, and manufacturing.

-

Google Cloud launched the “europe-west10” region in Berlin in Q3 2023 to enhance data sovereignty and local resilience.

-

European growth is consistent—Europe’s hybrid cloud CAGR via Straits Research is 12.4% through 2033.

-

Germany benefits from multicloud strategies, data protection compliance, and industry innovation.

Competitive Landscape & Commutator Analysis

The hybrid cloud domain is moderately concentrated, dominated by hyperscalers and solutions vendors, yet open to strategic specialized players.

-

Amazon Web Services (AWS): Holds ~31% infra share in Q1 2023.

-

Microsoft Azure: Close second (~25%), strong in enterprise, tight hybrid integration via Azure Arc.

-

Google Cloud: ~11% share in Q1 2023, building hybrid capacity via Anthos and Berlin region .

-

Other major providers: IBM (with Red Hat), Oracle, Alibaba, Tencent Cloud. Tencent Cloud holds ~2% of global share, expanding globally with data centers in Virginia and Frankfurt .

-

IBM: Strategic acquisitions (e.g., Instana, HashiCorp) in 2024 and 2025 bolster hybrid/AIOps offerings.

Commutator Analysis

“Commutator” refers to the switching mechanisms and orchestration tools used to manage workloads between private and public clouds:

-

Anthos (Google) and Azure Arc (Microsoft) offer unified control across environments, promoting governance and extensibility.

-

IBM’s OpenShift, Red Hat-based solutions, and HashiCorp integrations enable policy-driven deployment and container orchestration across clouds .

-

AWS Outposts, VMware Cloud on AWS, and providers such as Dell EMC and Cisco deliver hybrid stacks that mirror on-premises setups.

-

Open-source tools (Kubernetes, Terraform, Istio) are widely used for flexible, scalable orchestration.

These commutators are central to enabling interoperability, compliance, workload portability, and automated governance across hybrid environments.

Country & Regional Opportunities

-

North America continues to lead due to early tech adoption, mature governance frameworks, and hyperscaler dominance (~40% share in 2024).

-

Europe (including strong markets like Germany) maintains steady growth, focused on data sovereignty, regulatory compliance, and public-sector hybrid adoption .

-

Asia‑Pacific is the fastest-growing region—India at ~28% and China 23% CAGR by 2034—driven by digital infrastructure buildout and cloud acceleration .

Conclusion

The global hybrid cloud market is in the midst of a mature, multi-year upswing. With a projected market size between USD 300 bn and 600 bn by 2030–34, CAGRs are expected to range 12–22%, fueled by digital transformation, AI/edge adoption, security demands, and cloud-native innovation.

Key highlights:

-

Strong market growth: 2025 base between USD 114–172 billion; destinies rise to USD 300–580 billion by 2030–34.

-

Dominant Segments: Solutions (≈60% share), SaaS (≈55%), large enterprises lead, though SMEs grow fastest.

-

Top Verticals: BFSI and healthcare at the forefront.

-

Regional Leaders: North America (~40% share), fast-rising regions include APAC and Europe.

-

Competitive Arena: Led by AWS, Microsoft, Google; complemented by IBM, Oracle, Tencent, and open-source orchestration ecosystems.

-

Commutators: Platforms like Anthos, Azure Arc, OpenShift, Outposts, and open-source tools are key to seamless hybrid operations.

Opportunities ahead include expanding hybrid-native AI and edge workloads, commoditizing orchestration stacks, and serving compliance-driven industries.

Related Report: