The global Data Pipeline Tools Market is poised for rapid expansion—from USD 8.63 billion in 2023 to USD 30.75 billion by 2030, registering a substantial compound annual growth rate (CAGR) of 19.9%. These tools enable seamless data movement from varied sources such as CRM systems and cloud platforms, crucial for accelerating AI, big data analytics, ML, industrial IoT, and CRM capabilities.

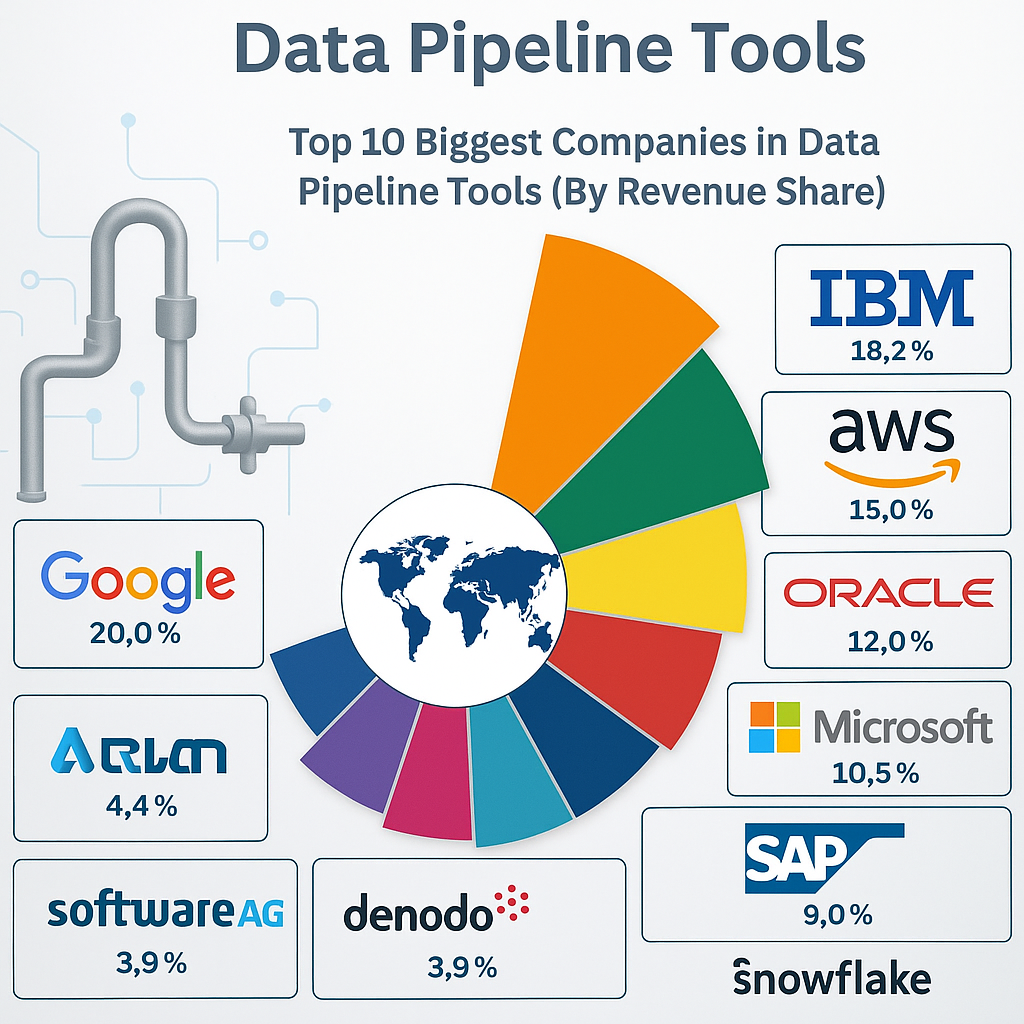

Competitive Landscape:

The market is driven by top-tier providers including Google, Oracle, Software AG, and Tibco, offering comprehensive end-to-end pipelines. Open-source frameworks such as Metaflow are gaining traction, particularly in real-world ML applications.

Regional Demand Snapshot:

North America leads in market share, supported by a strong IT infrastructure and deep presence of data-driven companies. Asia Pacific, notably India and China, is emerging as the fastest-growing region due to escalating IT investments and digital transformation .

Country‐Specific Highlights

Vietnam – Opportunity Growth in Vietnam

Vietnam is witnessing surging interest in digital supply chain modernization and smart manufacturing, prompting increased adoption of data pipelines. Startups and MNC affiliates are spearheading initiatives to automate data workflows, driven by government priorities on Industry 4.0.

Thailand – Trends Uptick in Thailand

Thailand’s booming e‑commerce and tourism sector are fueling demand for real-time analytics. Investments in regional data centers by cloud providers are generating new opportunities for pipeline tool deployment across retail and hospitality verticals.

Japan – Consolidation Growth in Japan

Japanese enterprises—especially in automotive and electronics—are consolidating data operations. Notable recent M&A includes Hitachi’s strategic acquisition of a domestic ETL startup to bolster its data orchestration platform, signaling industry consolidation and local innovation.

South Korea – Updation Trends in South Korea

South Korea’s telecom and semiconductor sectors prioritize pipeline upgrades to support 5G analytics and AI workloads. Samsung SDS launched enhanced modules for real-time ETL in Q1 2025. Local cloud providers are integrating third-party pipelines to enrich data service portfolios.

Singapore – Opportunity Growth in Singapore

Serving as APAC’s financial hub, Singapore is seeing strong demand for data pipelines in banking, insurance, and fintech. Government‑backed data sandbox programs are accelerating adoption. Recent partnership between DBS Bank and a leading pipeline vendor highlights private–public collaboration.

United States – Market Growth in the US

North America remains the global market lead. In 2024, Google acquired a leading ETL automation startup, while Oracle bolstered its cloud data offerings through strategic partnerships with integration platforms. Cross-border consolidation with European players has strengthened US market dominance.

China – Trends Growth in China

China’s big data revolution, centered around public sector infrastructure and industrial IoT, is driving pipeline tool consumption. Alibaba Cloud enhanced its PaaS pipeline services in late 2024. Local players like DataFountain have expanded from domestic to ASEAN markets via venture rounds.

Europe – Consolidation Opportunity in Europe

Europe exhibits robust regulatory-led data integration activity. European telcos and finance firms are consolidating data stacks, exemplified by Software AG’s acquisition of a UK-based data integration startup in early 2025. GDPR compliance remains a key driver for modern data orchestration technologies.

Request your sample copy of this report now: https://www.maximizemarketresearch.com/request-sample/182934/

Recent Mergers & Acquisitions (Country‑Wise)

- Japan: Hitachi acquired a domestic ETL solution provider in late-2024 to enhance ML pipeline capabilities.

- US: Google purchased a workflow automation ETL startup in mid-2024; Oracle formed alliances with major integration tool vendors.

- Europe: Software AG acquired a UK-based data integration startup (Q1 2025).

Key Recent Developments

- Metaflow (Open‑source) launched a framework in 2024 aimed at simplifying real-life ML data pipelines.

- Project Updates: Projects centered on IoT-to-cloud ingestion, real-time analytics, and secure data transfer gained momentum in manufacturing, healthcare, and telecom sectors.

Higher Demand Regions

- North America: Leads global demand, with strong investment in cloud-native, secure, real-time pipelines.

- Asia Pacific: Fastest-growing demand, notably from India, China, and Southeast Asia, driven by digital economy initiatives and local deployments.

Conclusion

The Data Pipeline Tools Market is entering a transformative growth phase, fueled by the rapid adoption of cloud computing, big data, AI, and IoT across industries worldwide. With a projected CAGR of 19.9%, reaching a market size of USD 30.75 Billion by 2030, the sector promises significant returns for stakeholders ranging from enterprises to investors.

While North America remains the undisputed leader in market share, countries like Vietnam, Thailand, Japan, South Korea, Singapore, the US, China, and key European regions are carving out distinct opportunities through digital transformation, regulatory shifts, and strategic mergers and acquisitions. Competitive dynamics are intensifying as tech giants like Google, Oracle, and Software AG continue to expand their global footprint through innovation and consolidation.

As organizations increasingly rely on automated, real-time, and scalable data solutions, the future of data pipeline tools lies in their ability to adapt, integrate, and transform raw data into actionable intelligence—driving smarter decisions across the global digital economy.