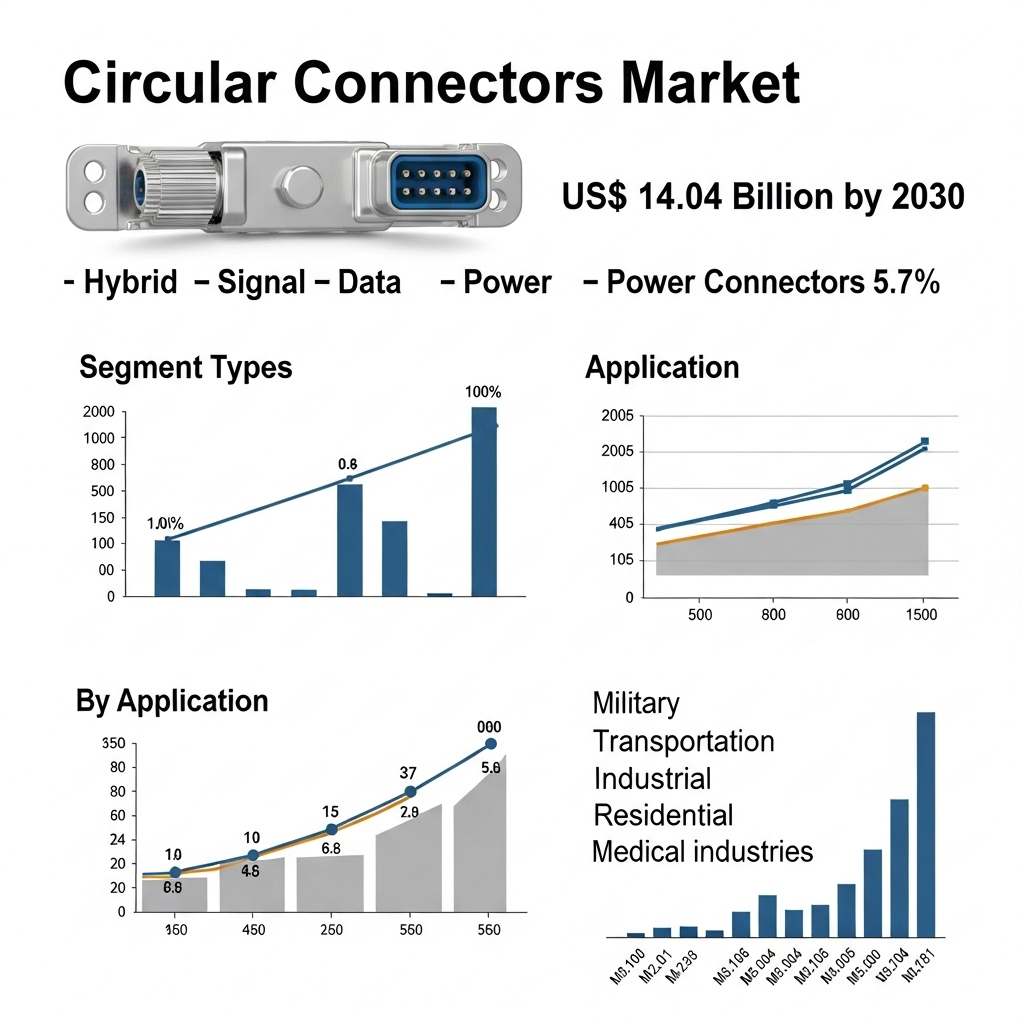

The Circular Connectors Market for is projected to grow from USD 9.52 Bn in 2023 to US D 14.04 Bn by 2030, registering a compound annual growth rate (CAGR) of 5.7 %. A surge in demand across industries—automotive, aerospace, medical, industrial automation—coupled with growing digitalization, is driving this momentum.

United States – Growth & Opportunity

The U.S. accounts for approximately 43 % of North America’s market, buoyed by substantial aerospace, defense investments, and rising power infrastructure needs

-

Growth: Booming aerospace and defense sectors demanding rugged, reliable connectors.

-

Opportunity: Military and space-grade circular connectors ideal for harsh environments.

Asia Pacific – Expansion & Trends

As the largest regional market (~40 % share in 2023), Asia Pacific is the fastest-growing, driven by expanding electronics and industrial sectors in China, India, and Japan .

-

Expansion: Rapid industrial automation across India and China.

-

Trends: Sharp rise in electric vehicles (EVs) fueling demand for high-speed and power hybrid circular connectors.

Europe – Innovation & Consolidation

Western Europe’s sustainability push is spurring innovation in eco-friendly connectors

-

Innovation: Manufacturers introducing recyclable-material connectors.

-

Consolidation: Strategic M&A seen—for instance, Amphenol’s ~$1.7 Bn acquisition of MTS Systems in 2021

Middle East & Africa – Opportunity & Trend

Though smaller in current market size, the region is gradually adopting circular connectors across growing power and telecom sectors.

-

Opportunity: Infrastructure expansion in energy and telecom.

-

Trend: Demand for rugged, high-IP-rated connectors suited to harsh environments.

For a broader understanding of this study, visit the webpage below

Competitive Landscape & Consolidation

Major market players—Amphenol, TE Connectivity, Molex, Belden, ITT—are executing strategic initiatives like M&A, partnerships, and product innovation

-

In 2021, Belden Inc. acquired OTN Systems N.V. for $71 millionAlso in 2021, Amphenol agreed to acquire MTS Systems for approx. $1.7 Bn

-

In 2024, Amphenol bought Carlisle’s CIT business for $2.025 Bn to enhance interconnect offerings

Key Recent Developments

-

United States: TE Connectivity acquired Intercontec Group, broadening its industrial automation portfolio

-

Japan: Hirose Electric launched a miniaturized high‑speed connector series for compact electronics

-

Europe: Molex introduced eco‑friendly circular connectors made from recyclable materials

-

South Korea: Amphenol strengthened its Asian footprint by acquiring a local connector manufacturer

Regional Headlines

-

“Circular connector growth in United States”: Aerospace & defense modernization is fueling demand.

-

“Circular connector opportunities in Asia Pacific”: Large-scale automation and EV adoption.

-

“Circular connector trends in Europe”: Eco-friendly designs and sustainable manufacturing.

-

“Circular connector consolidation in Middle East & Africa”: Infrastructure play boosts regional supplier tie‑ups.

Related Post: