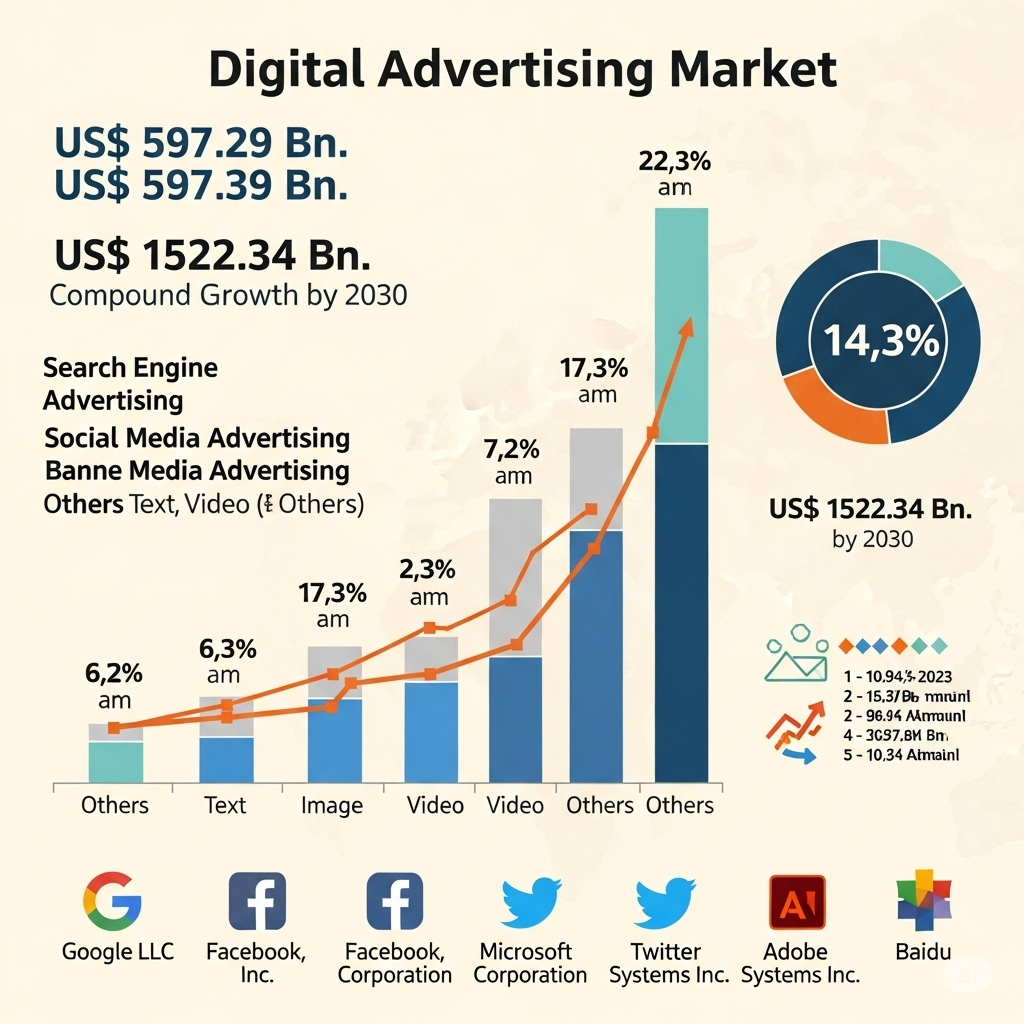

The Digital Advertising Market reached an estimated US $ 597.29 billion in 2023, and is projected to soar to US $ 1522.34 Billion by 2030, growing at a CAGR of 14.3% from 2025 to 2030. Fueled by soaring demand for video ads, mobile platforms, and AI-powered targeting, the industry landscape is rapidly evolving. North America currently leads in adoption, while Asia-Pacific is the fastest-growing region.

United States – Growth & Opportunity

-

Growth: The U.S. digital ad spend is expected to reach US $379 billion by 2025, propelled by dominance in search, video, and programmatic advertising .

-

Opportunity: Marketers are shifting more budgets from traditional to digital channels, with digital comprising 73 % of total ad revenue by 2025.

Asia Pacific – Expansion & Trends

-

Expansion: Boasting the fastest growth, APAC held ~34 % of the online ad market in 2025 and is anticipated to grow at 17 % CAGR in coming years.

-

Trends: India’s ultra-fast mobile proliferation and Southeast Asia’s AI-driven video ads and programmatic platforms are key trends.

Europe – Innovation & Consolidation

-

Trends: European markets, especially the UK, now see 81 % of ad spend on digital, with growth near 7 %—well above the regional average .

-

Consolidation: Major ad holding companies like Omnicom and Interpublic Group are merging to form global powerhouses.

Middle East & Africa – Opportunity & Updation

-

Opportunity: MEA is experiencing fast e-commerce and mobile growth, making it a hotspot for digital ad investment.

-

Updation: Launch of CTV, short-form mobile video, and immersive ad formats are rapidly transforming local advertising capabilities.

To access the full scope of this research, check the following page

Competitive Landscape & Consolidation

Key global players include Google, Meta, Amazon, Microsoft, Alibaba, and ByteDance. In 2024 alone, digital platforms generated over half the global ad revenues—contributing to a US $1 trillion+ market.

Major recent moves:

-

Microsoft’s collaboration with Netflix on an ad-supported tier .

-

Verizon partnering with Reset Digital to enhance programmatic reach.

Key Recent Developments

-

AI integration is reshaping ad targeting—AI could command 20 % of ad market by 2029.

-

Programmatic video and commerce-linked display ads now dominate short-form mobile platforms.

-

Retailers in North America and Europe are launching in-house ad networks tied to loyalty data.

Headlines by Region

-

“Digital advertising growth in United States”: U.S. market expected to reach US $379 billion by 2025.

-

“Digital advertising opportunities in Asia Pacific”: APAC’s 17 % CAGR driven by mobile and AI video.

-

“Digital advertising trends in Europe”: UK leads with 81 % digital ad share.

-

“Digital advertising consolidation in Middle East & Africa”: Rising e‑commerce and mobile consumption attract global platforms.

Related Post: