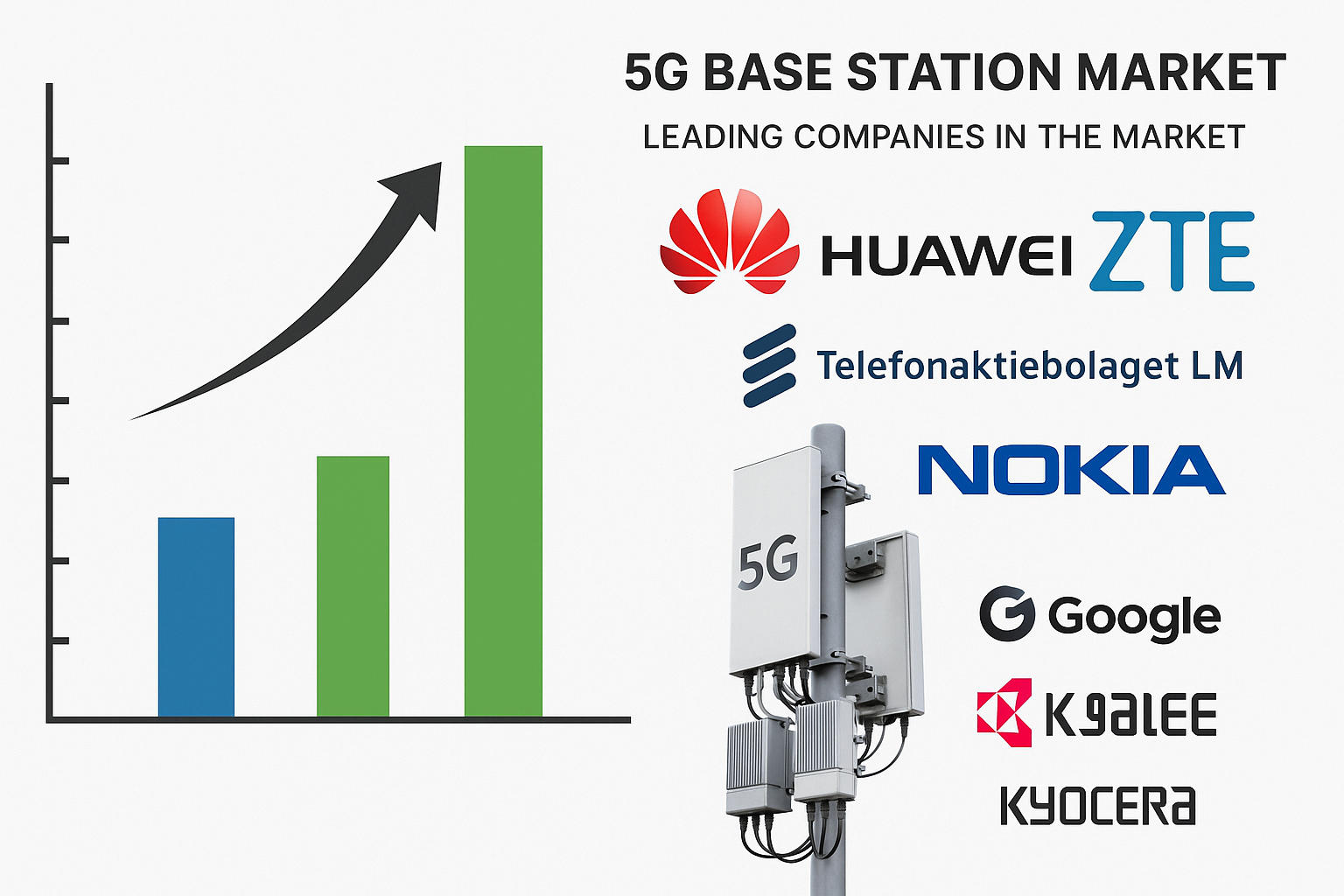

The 5G Base Station Market size was valued at USD 28.92 billion in 2024 and is on track to skyrocket to approximately USD 363.13 billion by 2032, growing at a robust CAGR of 37.2% from 2025 to 2032.The 5G Base Station Market is witnessing an unprecedented expansion, fueled by surging demand for high-speed connectivity, industrial digitization, and the rollout of national 5G initiatives.

5G Base Station Market Definition & Estimation

Definition

A 5G base station—comprising macro, micro, pico, and small cell hardware plus associated infrastructure—serves as the critical interface between mobile devices, objects (such as IoT), and the core network. It supports ultra‑high-speed data, massive device connectivity, and ultra‑low-latency performance, enabling applications from AR/VR and smart factories to autonomous vehicles.

Market Estimation

In 2024, the 5G Base Station Market’s valuation stood at USD 28.92 billion, based on extensive analysis of shipments, pricing intensity, and capital expenditure trends. Projected to grow at a 37.2% CAGR, the market is expected to swell to nearly USD 363.13 billion by 2032 . Discrepancies in estimates—from USD 308 B to USD 468 B by 2032 across sources—highlight optimistic momentum driven by infrastructure rollouts and government funding.

Growth Drivers & Opportunities

- Massive Data Demand: Increasing consumer and enterprise data traffic prompts operators to densify networks, spurring base station deployment.

- National 5G Programs: Governments worldwide are allocating multibillion-dollar budgets to support 5G towers—e.g., the U.S. earmarked USD 9 billion for rural broadband.

- IoT & Smart Cities: Smart city initiatives, industrial automation, and connected vehicles demand ubiquitous, low-latency coverage.

- Advanced Technologies: Innovations like MIMO, beamforming, Open RAN, and AI-driven network slicing are boosting network efficiency and encouraging upgrades.

- Private & Industrial Networks: Enterprises are deploying private 5G for applications like manufacturing, logistics, and campus connectivity.

Opportunities

- Proliferation of Open RAN, allowing flexible vendor ecosystems.

- Expansion into non-urban deployments, notably in remote IoT and Rural Connectivity projects.

- Integration with edge-computing platforms to cater to latency-sensitive services.

Segmentation Analysis

By Type

- Macro Base Stations dominate current revenue due to their coverage advantages in urban and suburban networks.

- Small Cells, including micro, pico, and femto-cells, are surging as operators densify wireless footprints to meet bandwidth demands.

By Component

- Hardware—radios, antennas, and transceivers—accounts for the lion’s share of revenue, with software and services progressively gaining through virtualization and network orchestration layers.

By Network Architecture & Frequency

- Centralised RAN (C-RAN) takes precedent, though Open RAN adoption is rising due to vendor neutrality and cost benefits.

- Frequency Bands: Sub-6 GHz for wide-area coverage, and mmWave beams for ultra-high-speed hotspots.

By End‑User

- Telecom Operators currently drive demand.

- Industrial & Enterprise Deployments—like manufacturing, ports, campuses, transport hubs—constitute a high-growth secondary segment.

Country-Level Analysis

- United States: Heavy investment backed by government incentives and rural broadband grants; significant carrier-led densification.

- China: Leading global deployment with comprehensive urban and rural buildouts, strong domestic vendor presence.

- South Korea & Japan: High-tech deployments focused on mmWave and Open RAN for next-gen services.

- Europe: Major networks in Germany, UK, France balance macro buildouts with industrial campus trials.

- India: Rapid expansion via Bharti Airtel, Reliance Jio, and Vodafone Idea, using equipment from Ericsson, Nokia, and Samsung.

- Middle East & Africa: Smart city programs in GCC countries and growing infrastructure in South Africa and North Africa.

Competitor Analysis

- Huawei: Holds the largest share of global 5G base stations (approx. 70%), supported by aggressive R&D and competitive pricing.

- Ericsson: Recognized leader in RAN with AI-enabled radios; secured multi‑billion contracts in India’s Airtel and Vodafone Idea networks.

- Nokia: Engaged in significant Indian contracts (Airtel), boosting its AirScale radios presence .

- Samsung & ZTE: Aggressively targeting Open RAN tenders in Asia, Europe, and Latin America.

- Others: Qualcomm, CommScope, Cisco, Marvell, NEC, and Airspan are active innovators in chipset, antenna, and edge-systems niches.

Conclusion

The global 5G base station market is entering a phase of exponential growth, driven by urban densification, state-backed investments, and evolving enterprise use-cases. With revenues set to surge from USD 28.92 billion in 2024 to an estimated USD 363.13 billion by 2032, operators and vendors are investing heavily in advanced hardware, Open RAN, and private network solutions. Market leaders—Huawei, Ericsson, Nokia, Samsung—compete around performance, efficiency, and flexible architectures. As smart cities, Industry 4.0, and next-gen services become mainstream, the 5G base station infrastructure market stands as a foundational pillar for digital transformation worldwide.